Standard Chartered Transforms Corporate Banking Experience with AI-powered Assistant in 43 Countries

Partnering with Gupshup, the multinational bank deployed an AI-powered digital assistant that provides real-time support for corporate banking customers, reducing operational costs while delivering seamless 24/7 assistance across multiple languages and time zones.

Scaling Standard Chartered's digital assistant globally

43+

4+

200+

Cost-optimized multilingual support delivering superior service

About the Brand

Standard Chartered Bank is a multinational financial services company headquartered in London, UK. It provides banking and financial services to individuals, businesses, and corporations across the globe in 70+ countries. Standard Chartered Bank’s corporate banking division offers a wide range of products and services to its corporate clients, including trade finance, cash management, foreign exchange, and other banking services.

The Brand’s Challenge

Meeting Rising Digital Expectations in Corporate Banking

Standard Chartered recognized that corporate banking customers increasingly preferred digital channels over traditional communication methods. Phone and email support were becoming inadequate for meeting customer expectations of fast, seamless service, particularly for clients operating across different time zones who needed assistance outside regular business hours. The bank needed to modernize its customer service approach to provide immediate, intuitive support that could handle complex banking queries while reducing the burden on customer service representatives and improving overall client satisfaction.

The Solution

‘Straight2Bank’: A Next-Gen Digital Solution for Corporate Banking Customers

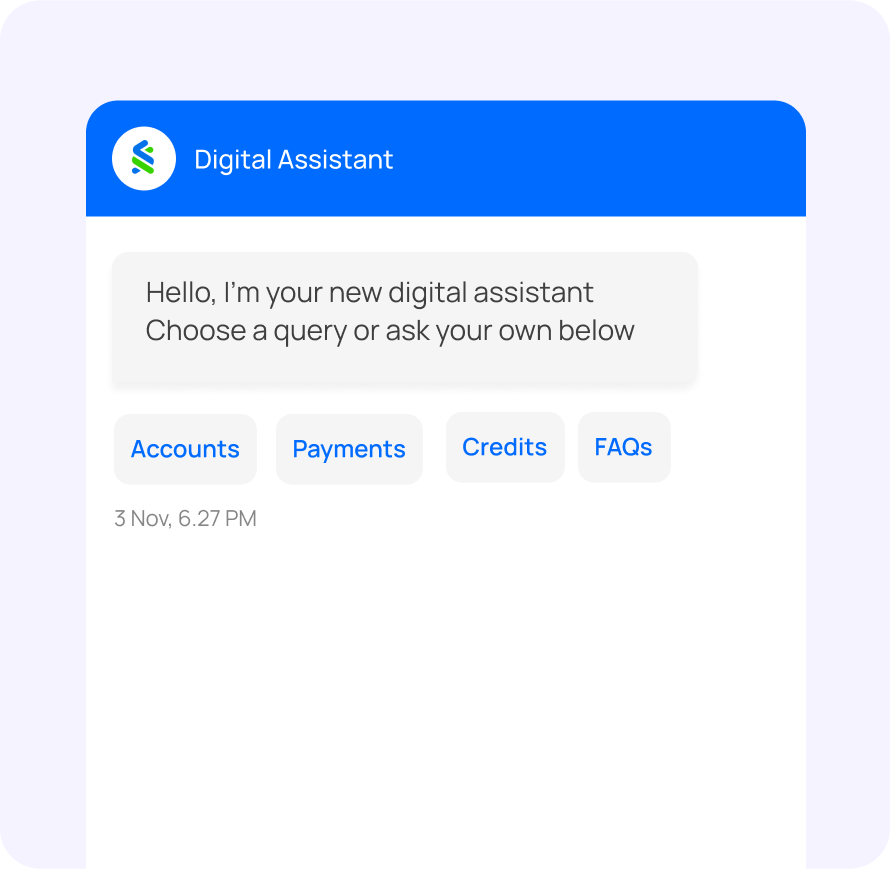

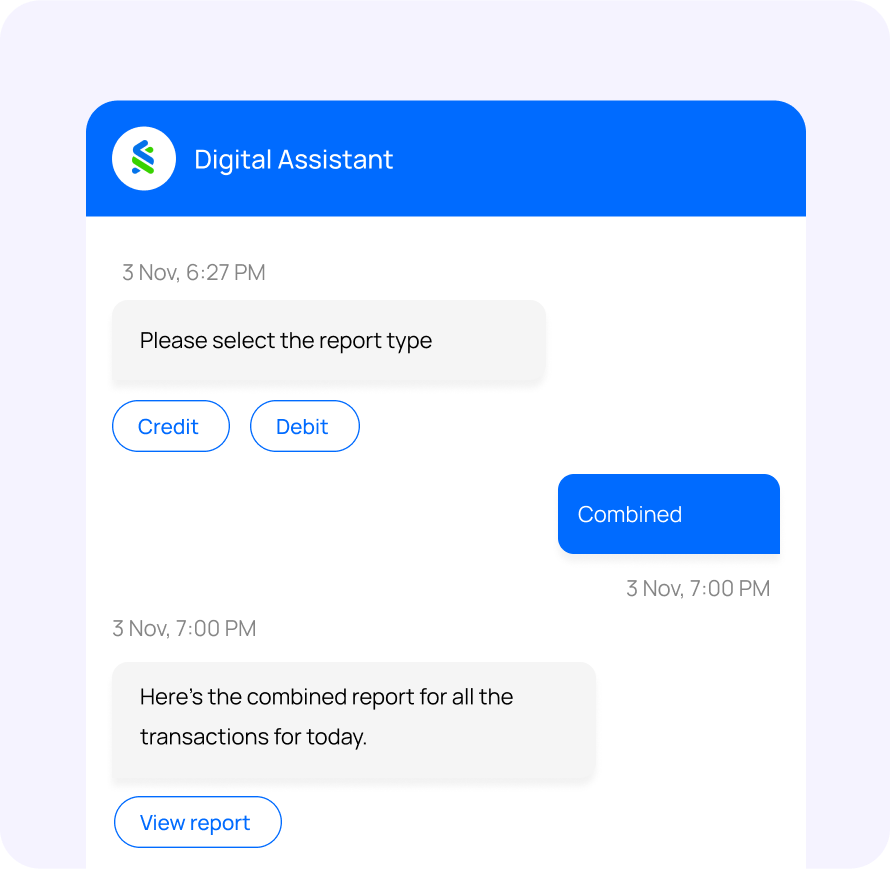

Standard Chartered partnered with Gupshup to launch the ‘Straight2Bank’ Digital Assistant, integrated directly into their corporate net banking platform. The AI-powered solution supports over 200 user stories across 4+ languages, including English, Chinese, and Bahasa. Available 24/7, the assistant handles payment inquiries, technical support, and MT103 download requests through natural language processing. Key features include smart feedback mechanisms, deep linking with the banking website, multi-level FAQ fallbacks, and seamless live chat handover for complex queries, ensuring comprehensive support for corporate clients globally.

The Success

The Results: Significant Cost Reduction and Enhanced Customer Experience

The ‘Straight2Bank’ Digital Assistant achieved widespread adoption among Standard Chartered’s corporate banking customers across global markets. The deployment resulted in a significant reduction in call volumes and email queries, particularly for routine technical support issues. Customer satisfaction scores improved dramatically due to the assistant’s speed and accuracy in query resolution. The solution freed up customer service representatives to focus on complex issues, reducing operational costs while enhancing overall customer experience. The success demonstrated the clear benefits of conversational AI in improving banking service delivery and operational efficiency.

Use Case Summary

Solution

Conversational Support

Channel

Webchat

Industry

Banking

+91-9355000192

+91-9355000192 Login

Login