How Tonik Bank Achieved 4.3X Productivity Boost with AI-Enabled Customer Support

How Tonik Bank Achieved 4.3X Productivity Boost with AI-Enabled Customer Support

Smart Banking, Smarter Savings:

$20 mn

95%

4.3X

Tonik Bank Cuts Costs with 95% AI Accuracy

About the Brand

Tonik Bank, one of the leading digital-only neobanks in the Philippines, offers a range of loan, deposit, and payment products through a highly secure digital banking platform. Tonik is officially the Philippines’ first neobank to secure a digital bank license from the Bangko Sentral ng Pilipinas (BSP). Deposits are insured by PDIC up to ₱1 Million per depositor.

The Brand’s Challenge

Scaling Support Without Breaking the Bank

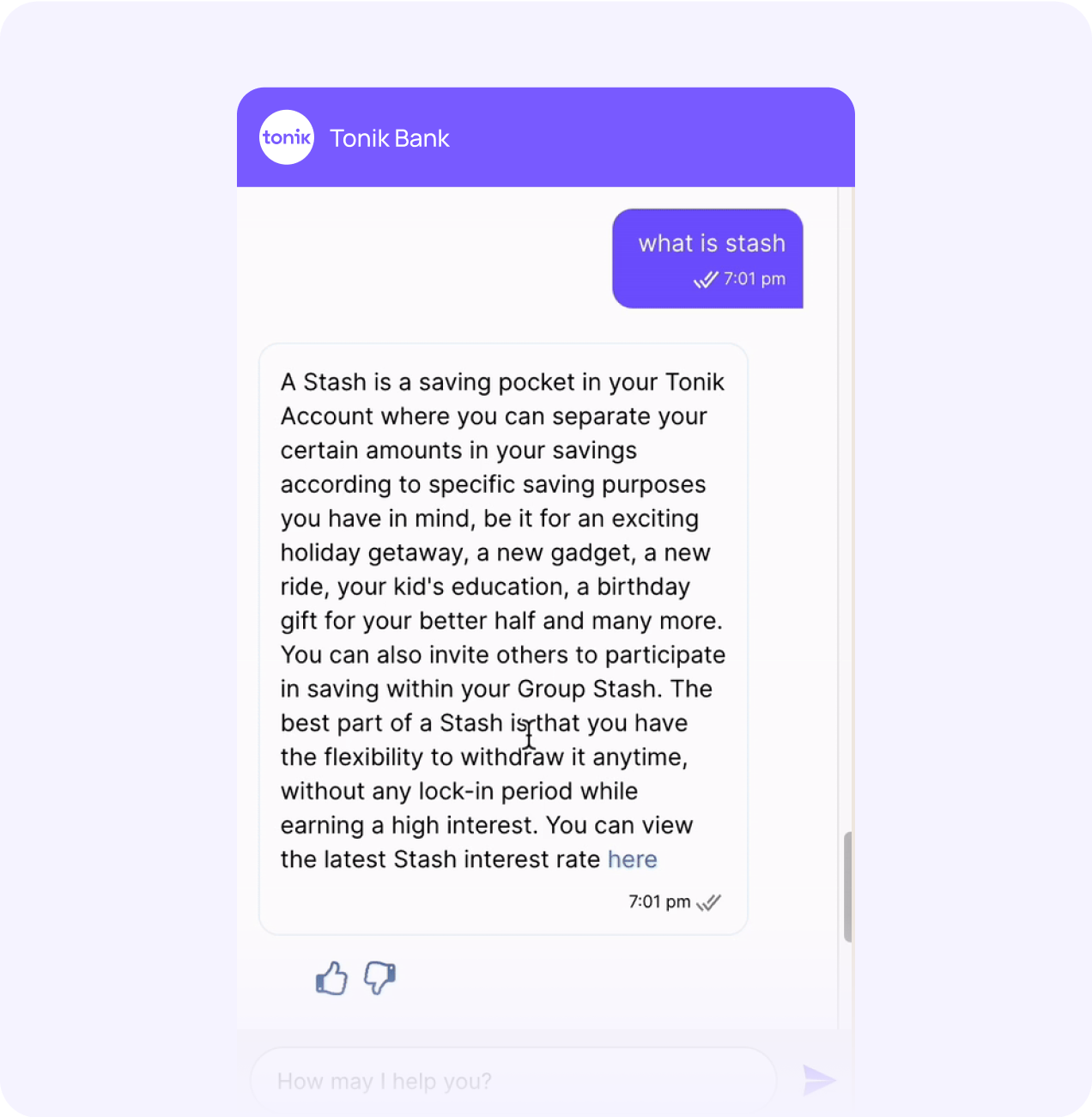

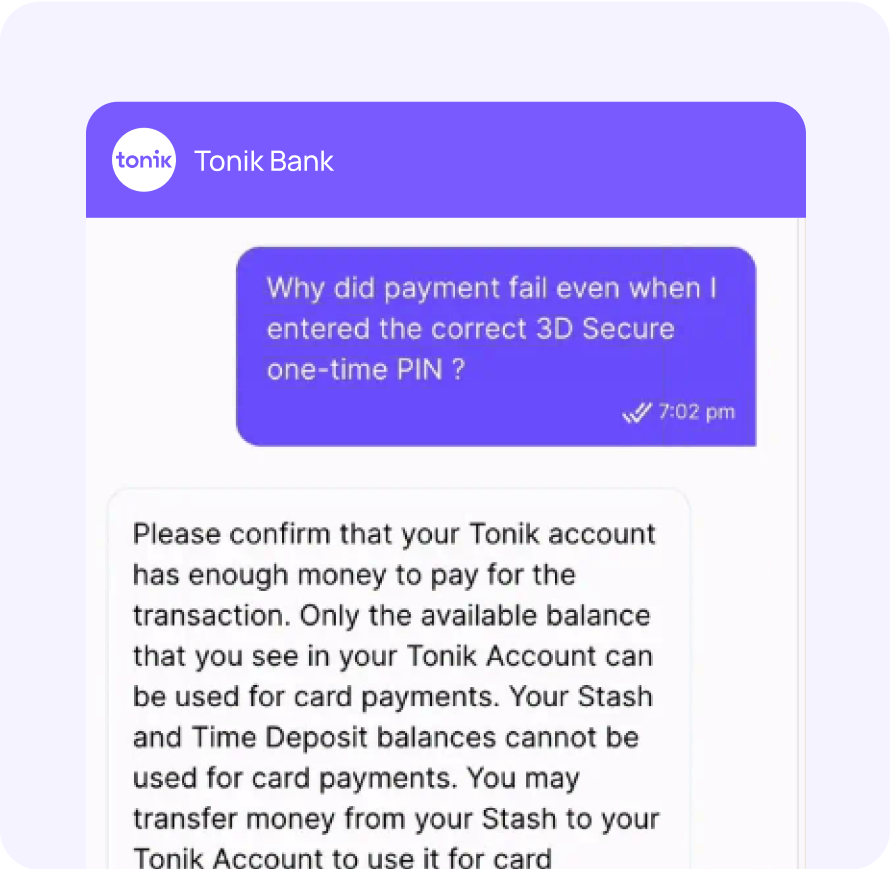

As one of the Philippines’ leading digital-only neobanks, Tonik Bank faced a critical challenge. With 1.5 million customers and a remarkable 2.5X surge in customer interactions, the bank’s existing NLP-based chatbot was struggling to keep pace. The system required constant manual training, especially as products and features evolved rapidly. While maintaining exceptional service quality remained paramount, Tonik needed a solution that could scale efficiently without dramatically increasing operational and contact center costs—a challenge that threatened to undermine their growth trajectory.

The Solution

Multi-Model AI Architecture for Seamless Automation

Tonik partnered with Gupshup to deploy an advanced Generative AI solution that revolutionized their customer service approach. The implementation featured Gupshup’s fine-tuned ACE LLM combined with traditional NLP models, creating a hybrid system optimized for latency, response quality, and cost-effectiveness. This multi-model architecture eliminated the need for constant retraining by enabling the chatbot to directly access real-time information from Tonik’s website and policy documents. The result was a self-learning system that maintained accuracy while adapting to evolving banking products and services automatically.

The Success

Transforming Banking Operations Through AI Innovation

By deploying Gupshup’s advanced conversational AI solution, Tonik created a self-learning system that dynamically pulls information from live bank documents and policies, eliminating the constant retraining burden. The results were transformative: 75% of customer queries now resolve autonomously with 95% accuracy, while customer care productivity increased 4.3X. Nine out of ten queries are handled through in-app chat, enabling staff to focus on complex issues. This AI-driven transformation is projected to save USD 20 million over three years while maintaining headcount growth below 20%, positioning Tonik as a leader in conversational banking innovation.

Use Case Summary

Solution

AI Assistant

Channel

Industry

Banking

+91-9355000192

+91-9355000192 Login

Login